September 14, 2010

Board of Directors

SeaChange, International, Inc.

50 Nagog Park

Acton, MA 01720

cc: William C. Styslinger, III, Chairman and Chief Executive Officer

Yvette M. Kanouff, President

Kevin M. Bisson, Chief Financial Officer

To the Board of Directors of SeaChange:

Ramius Value and Opportunity Advisors LLC, a subsidiary of Ramius LLC, together with certain of its affiliates (collectively, “Ramius”), is one of the largest shareholders of SeaChange International, Inc. (“SeaChange” or the “Company”), owning approximately 8.9% of the shares outstanding. We are deeply disappointed and concerned with the Company’s fiscal second quarter 2011 earnings release and the conference call on September 2, 2010. Evidently, so are other shareholders, given the steep 15.6% decline in SeaChange’s stock price on the following day.

Our disappointment and concern center on three key issues:

|

|

1.

|

Following its poor margin performance in the first two quarters, the core Software business appears set to fall far short of the 10% pre-tax margin goal that the Company publicly committed to for the full fiscal year 2011.

|

|

|

2.

|

The decision was made to continue to operate the Servers and Storage business, despite Chief Executive Officer Bill Styslinger’s acknowledgement that the Company has received several offers to acquire this business and that it is non-core and deteriorating fundamentally.

|

|

|

3.

|

Management credibility appears to be extremely low, given the Company’s failure to follow through on commitments to shareholders over time.

|

Software Segment Pre-tax Margins Are Tracking Far Below Committed Levels

With regard to the Software business, Mr. Styslinger stated in the June 3, 2010 press release announcing the Company’s settlement agreement with Ramius that:

“Our Company is committed to reaching pre-tax margins within the Software segment of 10% for the full year fiscal 2011 and 15% for the full year fiscal 2012 through R&D cost reductions and other measures within our control.” – Bill Styslinger, Company press release, June 3, 2010.1

However, Software segment pre-tax margins were approximately 3% in the first quarter and less than 2% in the second quarter, far below the committed margin levels of 10% for the full year fiscal 2011. Gross margins were several hundred basis points below expectations in both quarters and, despite management’s commitment to reduce costs, operating expenses increased in the first quarter and were flat in the second quarter. Without substantial and immediate cost reductions, it appears the Company will fall short of achieving its publicly-stated margin targets for the full year fiscal 2011. Such drastic underperformance relative to recently committed goals is unacceptable and requires prompt action.

We urge the Board to examine the following key questions:

|

|

1.

|

If senior management expected to meet its Software pre-tax margin targets “through R&D cost reductions and other measures within our control,” as stated above, then why hasn’t senior management taken the necessary significant action to reduce costs to accomplish this goal?

|

|

|

2.

|

If for some reason senior management now believes it is unable to meet these targets through measures within its control, then what has changed in the past few months to cause senior management to change its position? We question whether the CEO understands the dynamics of the business that are outside of his control.

|

Commentary on recent Software gross margin performance seems to indicate that the CEO may not have his finger on the pulse of this business. On May 27, 2010, Mr. Styslinger assured investors on the first quarter earnings call that the Software gross margin weakness in the first quarter was due to a one-time licensing deal related to the displacement of a competitor at one of the Company’s largest US cable television customers:

“… on the software [gross] margins, that was a very temporary thing for this one deal that took the [gross] margins down, but they will respond right back up in the current quarter.” – Bill Styslinger, fiscal 1Q11 earnings conference call, May 27, 2010.2

|

|

1 The Company first stated this goal in its fiscal fourth quarter and full year 2010 earnings press release dated March 11, 2010

|

|

|

2 [gross] added for clarification

|

However, Software gross margins in the second fiscal quarter were equally disappointing. Second quarter 2011 Software gross margins were 53.8%, down slightly from 53.9% in the first quarter, and down significantly from 60.6% in the second quarter of 2010. This result also compares with the Company’s “clear expectation of a long term 60% gross margin.”3

With regard to the fiscal second quarter Software gross margin performance, Mr. Styslinger commented:

“The [gross]4 margins being lower than what we thought they would be for the year in software are a bit of a surprise to us.” – Bill Styslinger, fiscal 2Q11 earnings conference call, September 2, 2010.

It is concerning that the CEO has been unable to forecast performance of the Software business, even over such a short period of time, despite the high level of recurring revenue and customer visibility.

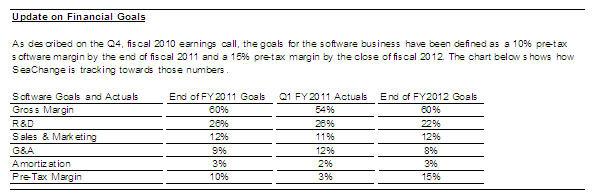

What is just as troubling as our concern about the Software pre-tax margin shortfall and its implications, is the manner in which the Company chose to communicate this information to its shareholders. In the first quarter fiscal 2011 earnings press release issued on May 27, 2010, a section called “Update on Financial Goals” included a clear discussion of the Company’s Software pre-tax margin goals for fiscal 2011 and fiscal 2012 as well as a table demonstrating the Company’s progress towards those goals. This appeared to be an effort at transparency and accountability through a quarterly report card to measure the tracking of a goal.

Then, surprisingly, in the fiscal second quarter, the Company appears to have moved away from reporting progress towards this goal. The “Update on Financial Goals” section and accompanying table, as well as any discussion or documentation of fiscal second quarter Software pre-tax margin results, which declined to less than 2% versus roughly 3% in the first quarter, were noticeably absent from the second quarter earnings release issued on September 2, 2010. Such inconsistency and lack of transparency on the key financial metrics that the Company agreed to be measured against by its shareholders is unacceptable.

We believe shareholders are entitled to answers to the following questions:

|

|

1.

|

Does the Company think these metrics are no longer relevant?

|

|

|

2.

|

Does the Company believe the goals are no longer achievable?

|

|

|

3.

|

Does the Company have a new timetable for when these goals will be reached?

|

|

|

4.

|

Who is being held accountable for achieving, or failing to achieve, these goals?

|

Decision to Continue Operating the Servers and Storage Business

The text of the fiscal second quarter 2011 earnings press release includes the following excerpt on the Company’s decision to restructure the Servers and Storage business:

Over the past few quarters SeaChange has gone through the strategic options for the server business including the evaluation of a potential sale or merging of the business, keeping in mind that a key goal is to ensure ongoing high quality support and upgradeability of its customer base. As of now, the Company has received several offers; however none are consistent with external analysis of the value of the business… the Company continues to see a weakening demand for streaming systems in the coming quarters and it has concerns about demand going forward. As a result, SeaChange has decided to greatly reduce the operational investment in the server business unit. – Fiscal 2Q11 earnings press release on September 2, 2010.

Furthermore, on the fiscal second quarter earnings conference call on September 2, 2010, Mr. Styslinger elaborated on the challenging fundamental outlook for the Servers and Storage business:

“My long-term view of the serving business is not good…. So there is a fundamental problem in the server business, and that is, I think, the streaming performance of systems is overwhelming the demand for streams. It's also very competitive with some very big competitors. So for us it's a very risky business….” – Bill Styslinger, fiscal second quarter earnings conference call on September 2, 2010.

We ask the Board to seriously consider its fiduciary duties to shareholders and to answer the following questions:

|

|

1.

|

What is the “external analysis” of the value of the Servers and Storage business?

|

|

|

2.

|

How does the “external analysis” incorporate expectations for “weakening demand” and the CEO’s “long-term view of the serving business [being] not good” into its valuation?

|

|

|

3.

|

How does the “external analysis” incorporate the previously stated goal to “ensure ongoing high quality support and upgradeability of its customer base,” following a sale of the Servers and Storage business, into its valuation?

|

|

|

4.

|

Does the “external analysis” consider the negative impact of the Servers and Storage segment on consolidated performance when deciding not to sell the business?

|

|

|

5.

|

What is the fair value for this money-losing5 business that also takes into account the previously stated customer transition issues following a sale of the hardware business, as well as the negative impact to consolidated performance of the Servers and Storage business?

|

|

|

6.

|

Is the Board comfortable with the decision not to sell the Servers and Storage business or should a sale be re-evaluated?

|

We do not believe it makes rational business sense to continue to operate this business with its attendant risks and negative pre-tax margins, rather than seek to maximize shareholder value by selling it to one of “several” interested acquirers. The Company’s alternative strategy to cut costs in the face of structurally weakening demand appears akin to trying to catch a falling knife.

The proper choice is clear. The Company should seek to sell this non-core, money-losing business as soon as possible and at the best possible price to a third party who can operate the business profitably and appropriately service SeaChange’s existing customer base. The sooner the Servers and Storage segment is sold, the sooner the Company can stem losses from this business and highlight the significantly higher value of the core Software business. Additionally, we believe there will be incremental benefits to eliminating the distraction of senior management’s time on the Servers and Storage business because it will allow management to focus on the core Software business.

Management Credibility

As we have already expressed to senior management and the Board, we believe that SeaChange’s core Software business is a high-quality business characterized by (i) a high level of recurring revenue; (ii) an attractive gross margin structure; (iii) industry-leading global market share; and (iv) substantial barriers to entry created by the stickiness of the Company’s back-office software. However, we believe that the Company is substantially undervalued in part because senior management’s credibility has been impaired over the years by both operating performance and the failure to follow through on its commitments to its shareholders.

|

|

5 The Servers and Storage business generated an estimated LTM pre-tax loss of $12 million

|

Consider the commentary of a concerned member of the investment community on the Company’s fiscal second quarter conference call on September 2, 2010:

“If you look at where SeaChange shareholders are today versus five years ago, they are still stuck in the same spot… it appears that credibility might be under assault right now as you guys finally have thrown in the towel in your hardware business – which, by the way, you guys should've done 12 months ago. And let's say quarterly conference calls would've, could've, should've doesn't bring the bacon home. But it's all about management credibility… So could you kindly tell me and the shareholders I represent what your plans are -- the best plans in use of cash going forward? So we can actually recognize a return on our investment that we have been patiently waiting on for the better part of the last four to five years. Thank you.” – Fiscal second quarter earnings conference call on September 2, 2010.

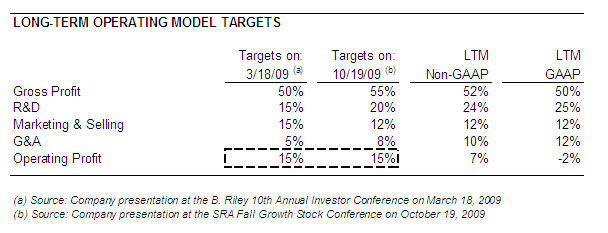

Dating back to June 7, 2007, as documented in an analyst report of B. Riley & Company, SeaChange’s management team has been making promises that it has not kept regarding the margin structure of the business:

“Whether SEAC can execute and begin to generate 15% operating margin within the next 2-3 years (the Company’s stated long-term goal), remains to be seen. – B. Riley & Company research report on June 7, 2007.

In two subsequent investor presentations, the first dated March 18, 2009, and the second dated October 19, 2009, the Company reiterated its “long-term operating model” target of 15% operating margins for the whole business:

Most recently, in its June 3 press release announcing the settlement agreement with Ramius, the Company shared a similar objective:

“Our objective is to achieve a 15% pre-tax margin for the entire company.” – Company press release issues on June 3, 2010.

Despite all of the promises over the years, SeaChange has not once come close to achieving these margin targets due to a bloated operating cost structure, particularly in research and development and general and administrative expenses, as highlighted in the table above. Furthermore, the Company has not once set a time frame for when it will realistically achieve these goals.

Call to Action for the Board of Directors

We urge the Board to carefully consider and vigorously discuss the contents of this letter and to proactively take action on the following issues:

|

|

·

|

Accountability: Hold management accountable for corporate performance. Achieve Software segment margin commitments and reasonable operating targets for the whole business within a specific time period, based on promised cost reductions and other measures within its control. For too long, management has failed to achieve its stated financial targets. It is your responsibility to ensure that senior management swiftly makes good on its commitments to shareholders or is held accountable for failing to do so.

|

|

|

·

|

Transparency and Consistency: The Board must ensure that communication with shareholders is transparent and consistent. In its fiscal first quarter press release, management included a section called “Update on Financial Goals” that provided a clear discussion of the Company’s Software pre-tax margin goals for fiscal 2011 and fiscal 2012 as well as a table demonstrating the Company’s progress towards those goals in the first quarter. This section and accompanying table were not included in the second quarter earnings release. Moving forward, both the “Update on Financial Goals” section and the accompanying table should be included consistently in all future earnings releases, as well as full disclosure of the data that management uses to calculate Software pre-tax margins. This level of transparency and consistency will allow the investment community to clearly track management’s progress against its stated goals.

|

|

|

·

|

Independence: The Board must act independently of management. To that end, we encourage the Board to immediately separate the Chairman and CEO responsibilities, an action that is in line with good corporate governance practices and which would ensure the true independence of the Board. Further, the Board should form a special committee comprised of independent directors tasked with evaluating operational, financial, and strategic objectives of the Company.

|

|

|

·

|

Strategic Review: The newly-created independent special committee should fully re-evaluate the decision not to sell the Servers and Storage segment. We strongly believe this segment should be sold in a timely manner and at the highest possible price, while considering the need for a seamless transition for the Company’s existing customers.

|

Further, the special committee should immediately engage a nationally-recognized investment bank to fully explore all strategic options to maximize value for shareholders including an outright sale of the Company. SeaChange is a valuable strategic asset given its dominant market share and competitive position in VOD software, particularly as its customers invest heavily in VOD over the next few years to strengthen and defend their lucrative video delivery franchises against other traditional service providers as well as non-traditional over-the-top competitors. This strategic value is not reflected in the current share price due to continued long-term underperformance and, therefore, the Board must take the necessary action to maximize shareholder value through a strategic sale of the Company.

We firmly believe that senior management and the Board have a compelling opportunity to unlock significant value by executing on the initiatives we have outlined above. We expect that management and the Board will adopt a greater sense of urgency in evaluating and urging management to execute on these and other opportunities to maximize shareholder value. We will continue to monitor the situation closely and hold you accountable. The status quo is not an acceptable outcome.

Best Regards,

/s/ Peter A. Feld

Peter A. Feld

Ramius LLC