The information in this proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/CONSENT SOLICITATION STATEMENT/PROSPECTUS - DATED FEBRUARY 22, 2022

|

|

MERGER PROPOSED - YOUR VOTE IS VERY IMPORTANT

Dear Stockholders of SeaChange International, Inc.,

On December 22, 2021, SeaChange International, Inc. (“SeaChange”) and Triller Hold Co LLC (“Triller”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), a copy of which is attached as Annex A to this proxy statement/prospectus. Under the terms of the Merger Agreement, Triller will be merged with and into SeaChange, and the separate existence of Triller shall cease, with SeaChange continuing as the surviving corporation. Upon the closing of the merger, the name of the combined company will be changed to “TrillerVerz Corp.”

Pursuant and subject to the terms and conditions of the Merger Agreement, in addition to other contemplated transactions, (i) SeaChange and Triller anticipate that Triller will conduct an offering of convertible notes prior to the closing of the merger in an amount in excess of $100 million (the “Triller Convertible Notes”), and (ii) the charter of the surviving company will provide for two classes of common stock, consisting of SeaChange Class A common stock and SeaChange Class B common stock (which Class B common stock is anticipated to provide for super-voting rights to provide its holders 76% or more of the total voting rights).

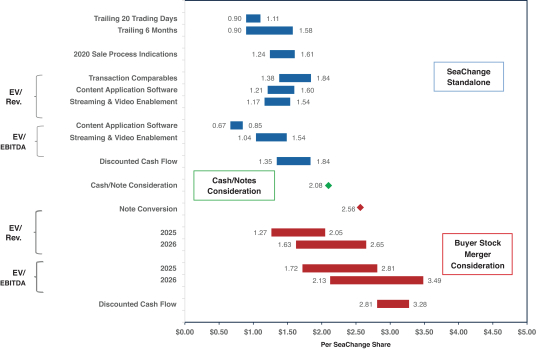

The stockholders of SeaChange will have the right to elect to receive either (i) their pro rata portion of $25 million cash consideration along with their pro rata portion of an aggregate $75 million in principal of notes (the “Notes Consideration”) to be issued by the surviving company to the holders of SeaChange common stock (such cash and notes consideration, the “Cash/Notes Consideration”) or (ii) a number of shares of SeaChange Class A common stock (the “Stock Consideration”), in an amount equal to that which such holder would have received if such SeaChange stockholder had purchased the Triller Convertible Notes in an aggregate amount equal to its pro rata portion of the Cash/Notes Consideration and then converted such Triller Convertible Notes at the conversion price at which such Triller Convertible Notes were issued and then participated pro-rata along with the Triller holders in the proposed merger. Assuming that (i) all holders of SeaChange common stock elect the Stock Consideration and (ii) that Triller issues $250 million of Triller Convertible Notes which convert in connection with the proposed merger at an agreed discount of 20% to an assumed $5 billion Triller valuation (before the conversion of the Triller Convertible Notes), the stockholders of SeaChange (including SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units) would own approximately 2.3% of the surviving company and the holders of Triller (including Triller optionholders and warrant holders) would hold approximately 97.7% of the surviving company. If all stockholders of SeaChange elected to receive the Cash/Notes Consideration, such stockholders would have no equity interest in the surviving company, and the Triller holders (including Triller optionholders and warrant holders) would collectively own 100% of the surviving company (other than SeaChange optionholders and holders of SeaChange deferred stock units, performance stock units and restricted stock units). For SeaChange stockholders that elect the Cash/Notes Consideration, each would receive their pro rata portion of such Cash/Notes Consideration which would then also reduce the resulting SeaChange stockholders’ ownership percentages by taking into account the payment of the Cash/Notes Consideration and related reduction in the Stock Consideration. The notes (the “Merger Consideration Notes”) to be issued to SeaChange stockholders who elect the Cash/Notes Consideration are payable on the one-year anniversary of issuance, bear interest at a rate of 5% per annum and will be automatically converted into SeaChange Class A common stock at such time as the market capitalization of the surviving company equals or exceeds $6 billion for ten consecutive trading days. The holders of the Merger Consideration Notes will have the option to convert into SeaChange Class A common stock if the surviving