We Power Successful Video Businesses February 2023 Exhibit 99.1

Disclaimer Forward-Looking Statement Certain statements in this presentation and any oral statements made regarding the contents of this presentation may constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended to date. Forward-looking statements can be identified by words such as "may," "might," "will," "should," "could," "expects," "plans," "anticipates," "believes," "seeks," "intends," "estimates," "predicts," "potential" or "continue," the negative of these terms and other comparable terminology. Examples of forward-looking statements include, among others, statements SeaChange International, Inc. (“SeaChange” or the “Company”) makes regarding Americans usage of connected TVs, the OTT services market size, digital advertising and marketing size, U.S. monthly CTV user figures, SeaChange’s future revenue size and the composition of such revenue, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of the Company and are subject to a number of known and unknown risks and significant business, economic and competitive uncertainties that could cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. Risks that could cause actual results to differ include, but are not limited to: a reduction in spending by customers on video solutions and services would adversely affect our business, financial condition and operating results; the increase in labor, service and supply costs, including as a result of inflationary pressures; the manner in which the multiscreen video and over-the-top markets develop; SeaChange may be unsuccessful in our efforts to become a company that primarily provides software solutions; the inability to successfully compete in our marketplace; the failure to respond to rapidly changing technologies related to multiscreen video; the variability in the market for our products and services; the loss of or reduction in demand, or the return of product, by one of the Company's large customers or the failure of revenue acceptance criteria to have been satisfied in a given fiscal quarter; the cancellation or deferral of purchases of our products or final customer acceptance; a decline in demand or average selling prices for our products and services; our entry into fixed-price contracts, which could subject us to losses if we have cost overruns; warranty claims on our products and any significant warranty expense in excess of estimates; the possibility that our software products contain serious errors or defects; turnover in our senior management; the failure to achieve our financial forecasts due to inaccurate sales forecasts or other factors, including due to expenses we may incur in fulfilling customer arrangements; the impact of our cost-savings and restructuring programs; the Company's ability to manage its growth; the risks associated with international operations; the effects of new outbreaks of COVID-19, including actions taken by governmental officials to curb the spread of the virus, and the resulting impact on general economic and financial market conditions and on the Company’s and our customers' business, results of operations, asset quality and financial condition; the efficacy of vaccines against the COVID-19 virus, including new variants; the impact of the ongoing conflict in Ukraine on our business; the ability of SeaChange to remain listed on Nasdaq; the success and timing of regulatory submissions; litigation regarding intellectual property rights; changes in the regulatory environment; significant risks to our business when we engage in the outsourcing of engineering work, including outsourcing of software work overseas; fluctuations in foreign currency exchange rates could negatively impact our financial results and cash flows; weakened global economic conditions that may harm our industry, business and results of operations; and other risks that are described in further detail in the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at http://www.sec.gov, including but not limited to, such information appearing under the caption "Risk Factors" in the Company's Annual Report on Form 10-K, subsequent quarterly reports and in subsequent filings SeaChange makes with the SEC from time to time, particularly under the heading “Risk Factors.” Any forward-looking statements should be considered in light of those risk factors. The Company cautions readers that such forward-looking statements speak only as of the date they are made. The Company disclaims any intent or obligation to publicly update or revise any such forward-looking statements to reflect any change in Company expectations or future events, conditions or circumstances on which any such forward-looking statements may be based, or that may affect the likelihood that actual results may differ from those set forth in such forward-looking statements.

Table of Contents 1 Executive Summary 2 Investment Highlights 3 SeaChange Products & Technologies 4 Financial Overview

Executive Summary

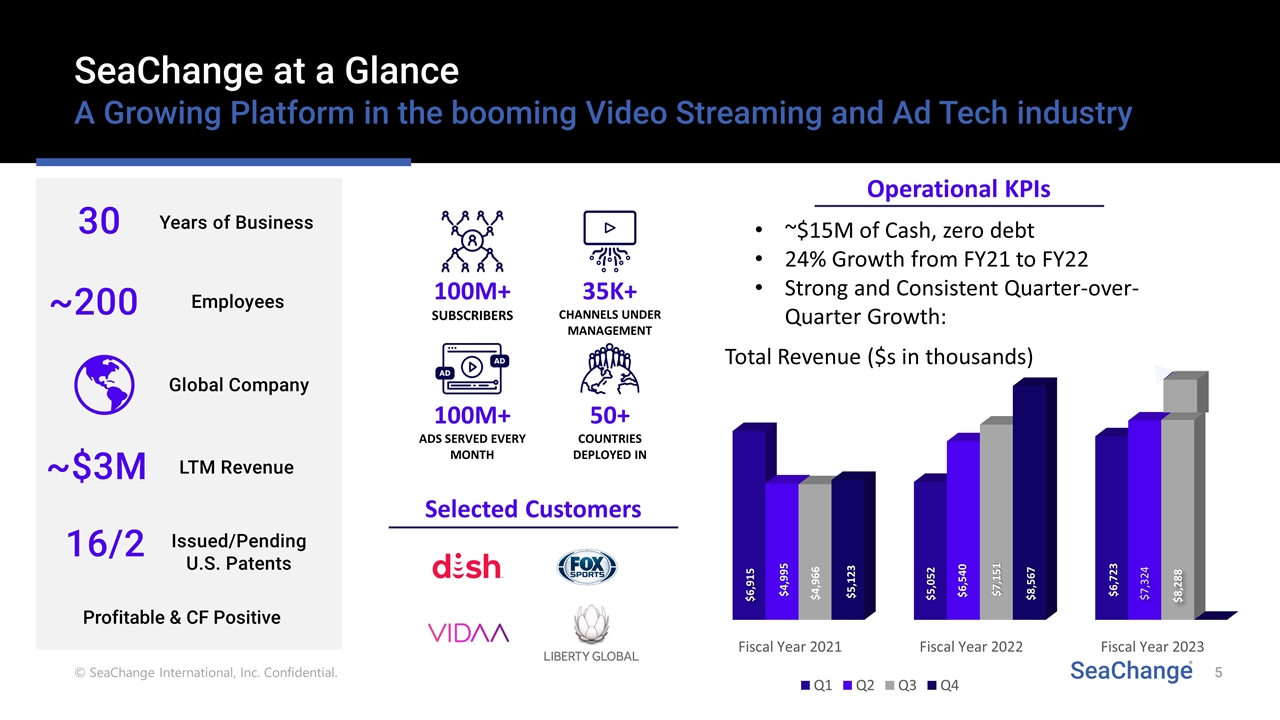

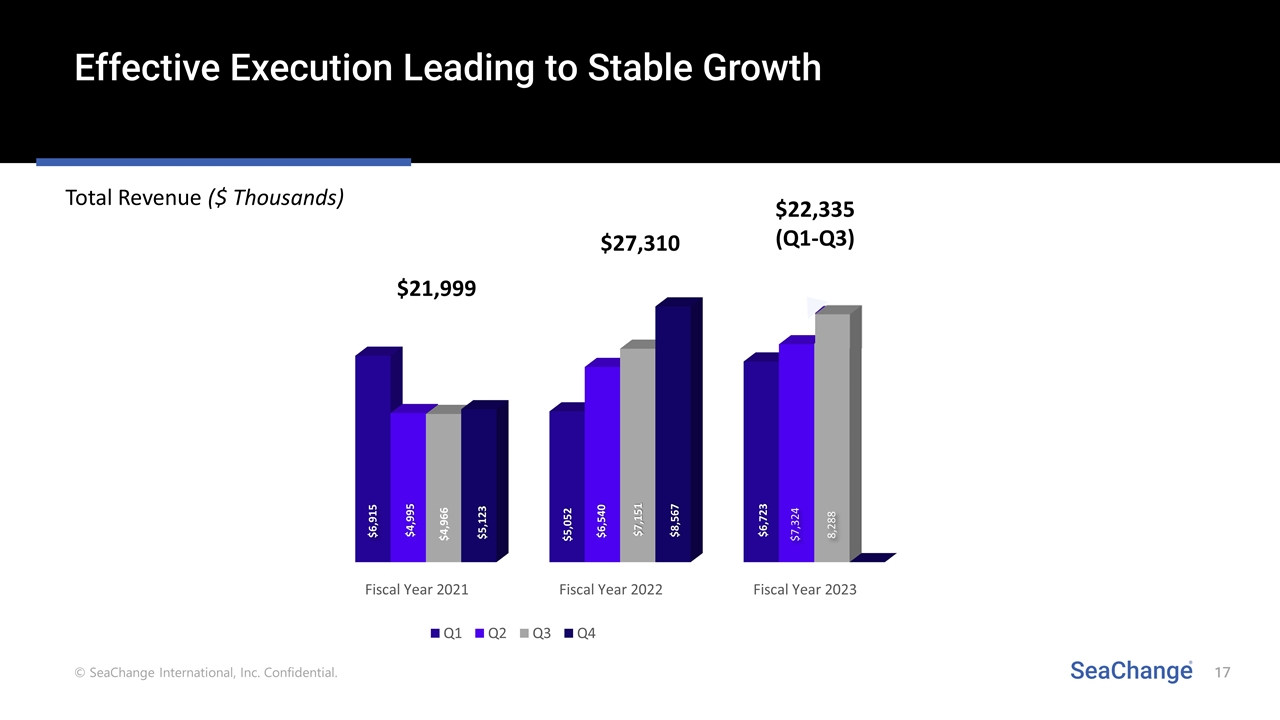

SeaChange at a Glance A Growing Platform in the booming Video Streaming and Ad Tech industry 100M+ ADS SERVED EVERY MONTH 100M+ SUBSCRIBERS 35K+ CHANNELS UNDER MANAGEMENT 50+ COUNTRIES DEPLOYED IN Global Company Profitable & CF Positive Years of Business 30 Employees ~200 LTM Revenue ~$3M Issued/Pending U.S. Patents 16/2 Selected Customers ~$15M of Cash, zero debt 24% Growth from FY21 to FY22 Strong and Consistent Quarter-over-Quarter Growth: Operational KPIs Total Revenue ($s in thousands)

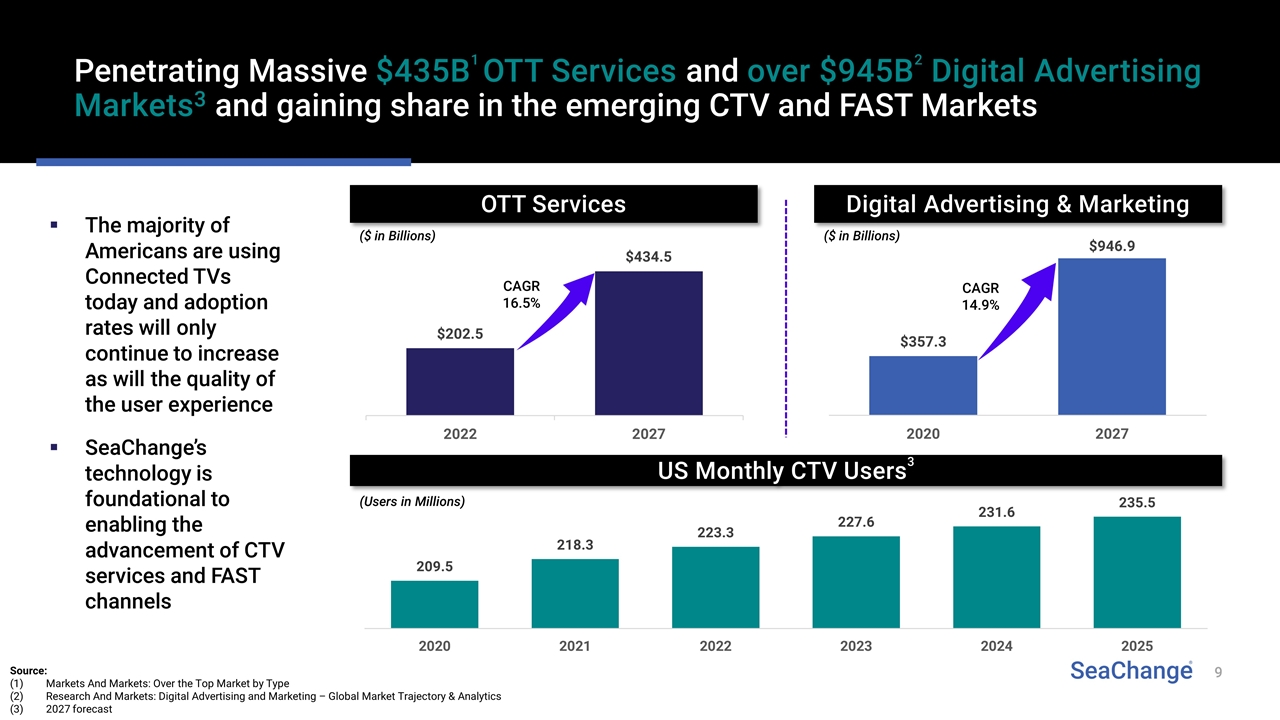

SeaChange Highlights 1 Leading video streaming, delivery and monetization solutions enable cable companies, telcos and publishers to maximize video revenues 5 Global, blue chip list of customers with long term contracts 2 Penetrating massive $435B1 OTT services and $950B2 digital advertising markets3 and gaining share in the emerging CTV and FAST markets 3 Experienced management team focused on accelerating organic and inorganic growth 4 Decades of technology thought leadership fueled by 100+ in house software engineers in Poland and 16 issued and 2 pending U.S. patents Source: Markets And Markets: Over the Top Market by Type Research And Markets: Digital Advertising and Marketing – Global Market Trajectory & Analytics 2027 forecast

Why We Win SeaChange Value Proposition Strong project governance in delivering complex software delivery projects Established company structure with talented employee base Proven reliability and expertise Provides tools that allow customers to create new revenue streams Serves as a partner to customers, fulfilling the full spectrum of technology and business needs

Investment Highlights

Source: Markets And Markets: Over the Top Market by Type Research And Markets: Digital Advertising and Marketing – Global Market Trajectory & Analytics 2027 forecast Penetrating Massive $435B1 OTT Services and over $945B2 Digital Advertising Markets3 and gaining share in the emerging CTV and FAST Markets US Monthly CTV Users3 (Users in Millions) The majority of Americans are using Connected TVs today and adoption rates will only continue to increase as will the quality of the user experience SeaChange’s technology is foundational to enabling the advancement of CTV services and FAST channels Digital Advertising & Marketing ($ in Billions) OTT Services ($ in Billions) CAGR 16.5% CAGR 14.9%

Experienced Management Team Focused on Accelerating Organic and Inorganic Growth Chris Klimmer President Peter D. Aquino Chairman & CEO Tenured TMT executive with decades of experience leading M&A roll-ups, corporate turnarounds and transformational growth Proven leader focused on executing key growth opportunities within streaming, FAST and CTV and transitioning SEAC to a SaaS based business model Mark Szynkowski CFO Pawel Luszczek SVP & CTO Elaine Martel VP & GC Drumeel Thakkar SVP & CSO

Center of engineering excellence in Warsaw, Poland 10+ year average tenure Resource investment strategy follows create, market, stabilize, maintain principle Funding of core and growth product lines managed from within the organization, shifting resources within the Warsaw Excellence Center 100+ Software Engineers 16 Issued U.S. Patents 2 U.S. Patents Pending Software Engineering Expenses Split On Prem Cloud $ in Thousands Decades of Technology Thought Leadership fueled by 100+ in house software engineers and 18 issued or pending patents

SeaChange Products & Technologies

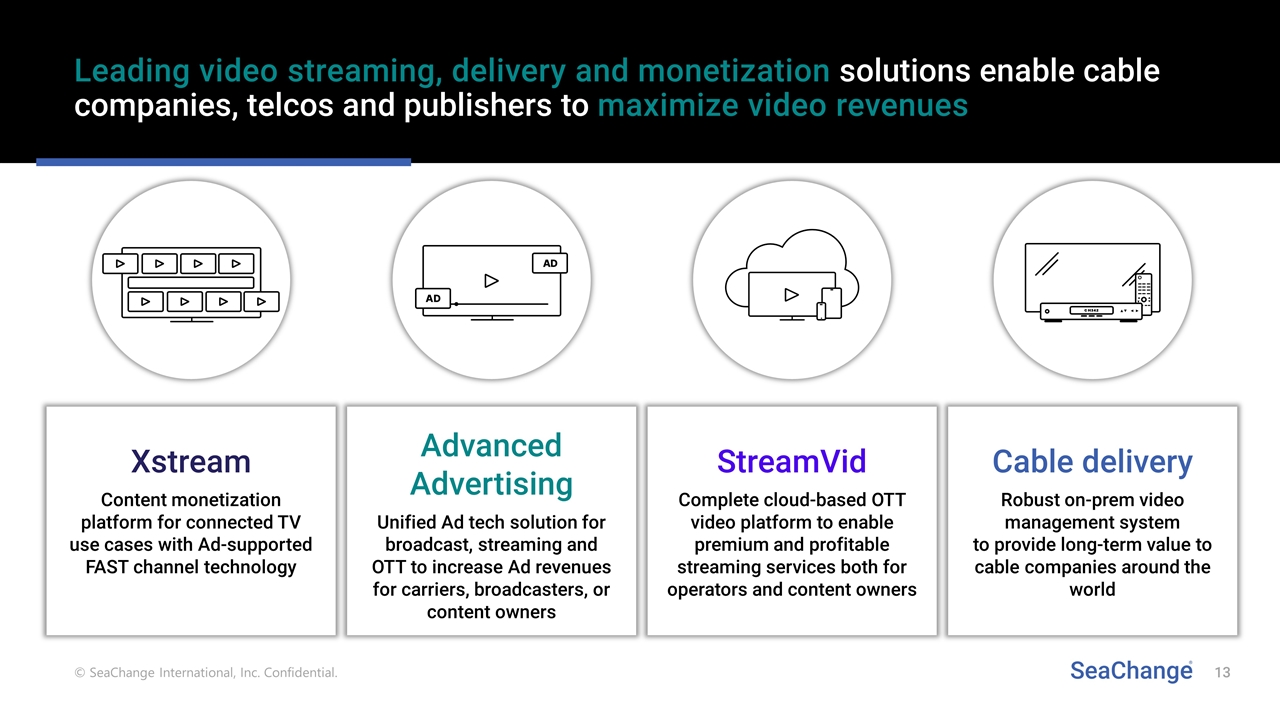

Leading video streaming, delivery and monetization solutions enable cable companies, telcos and publishers to maximize video revenues Advanced Advertising Unified Ad tech solution for broadcast, streaming and OTT to increase Ad revenues for carriers, broadcasters, or content owners StreamVid Complete cloud-based OTT video platform to enable premium and profitable streaming services both for operators and content owners Xstream Content monetization platform for connected TV use cases with Ad-supported FAST channel technology Cable delivery Robust on-prem video management system to provide long-term value to cable companies around the world

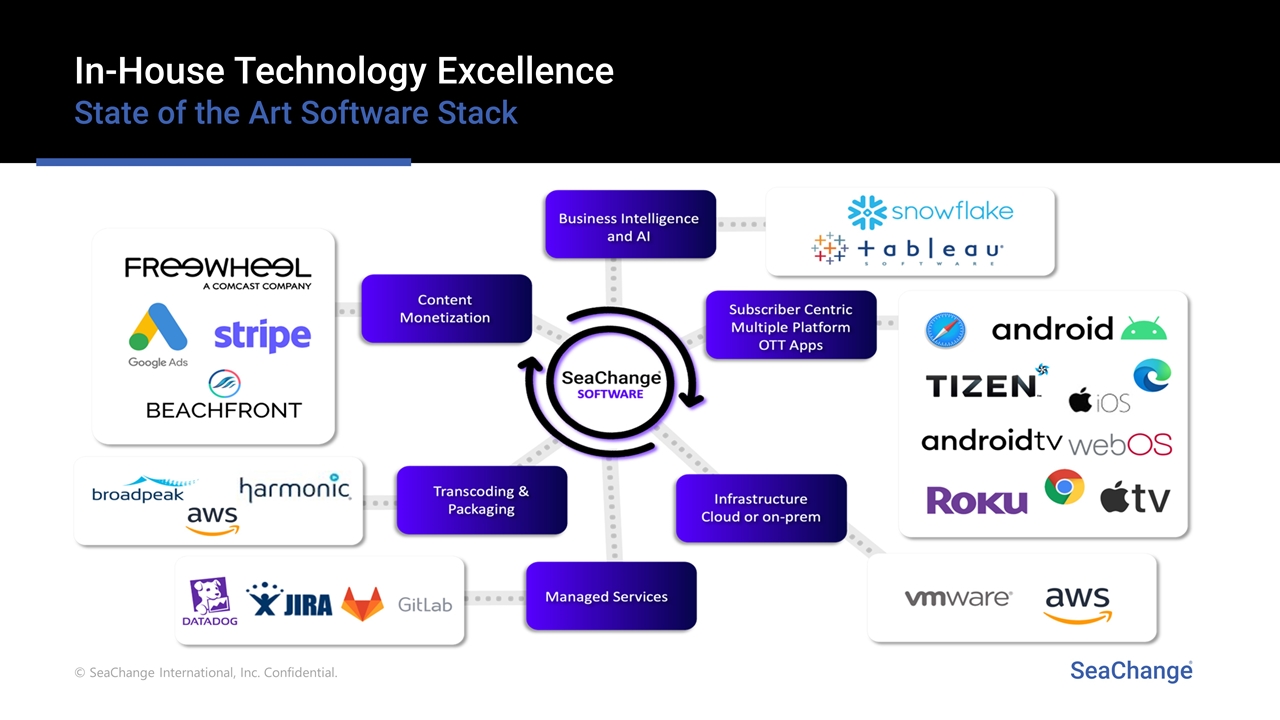

In-House Technology Excellence State of the Art Software Stack

Technological Innovation & Go-to-Market Strategy SeaChange is structured today to sell its capabilities around the world Expanding Customer Adoption Establish dedicated product lines for all current and future revenue drivers Increase asset value with clear value propositions, respective target verticals, and reference cases Drive targeted and relevant product innovation with our exceptional team of video software engineers Introduce growth vehicles for recurring revenue streams on streaming platform Advanced Advertising StreamVid Cable Delivery Xstream Growth Platforms Core Products

Financial Summary

Effective Execution Leading to Stable Growth $6,915 $21,999 $27,310 $22,335 (Q1-Q3) Total Revenue ($ Thousands)

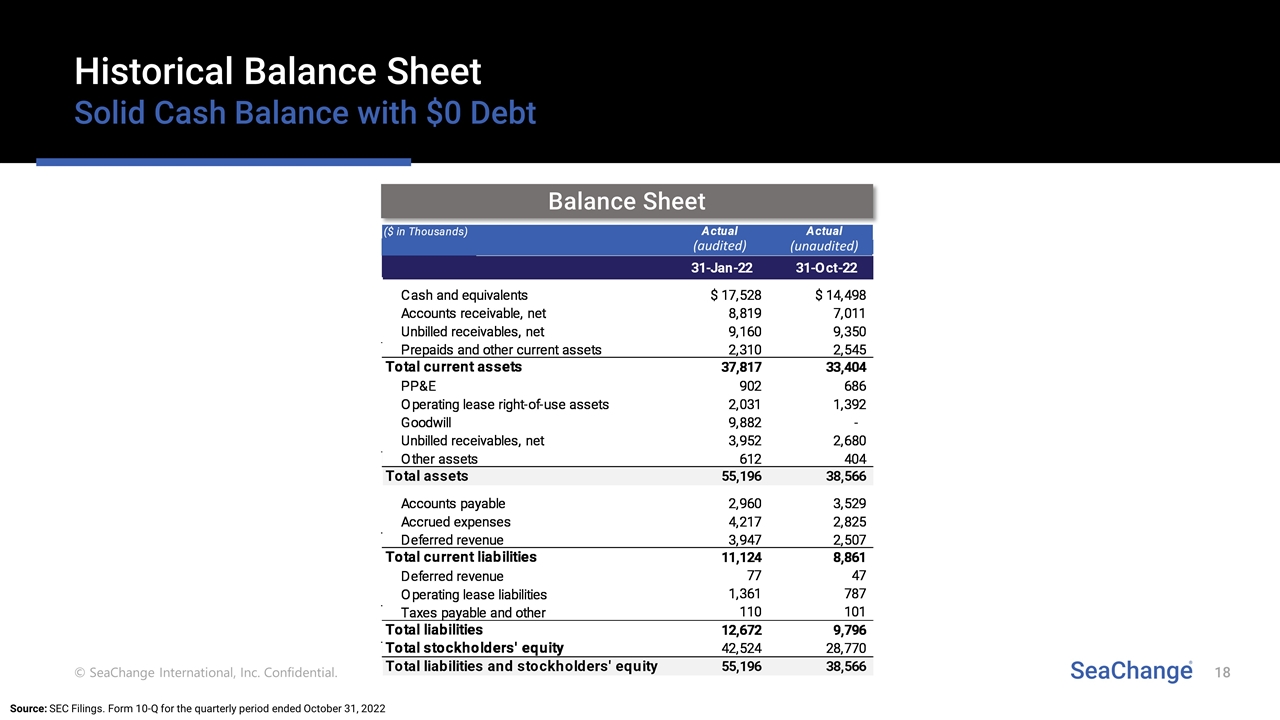

Historical Balance Sheet Solid Cash Balance with $0 Debt Balance Sheet Source: SEC Filings. Form 10-Q for the quarterly period ended October 31, 2022 (audited) (unaudited)

Thank You. Contact us at Matt Glover Gateway Investor Relations SEAC@gatewayir.com